Extreme sanctions on Russia have dramatically remade global trade flows Russia turns to its friends to act as transit countries for banned goods. And most have cooperated, both because of pressure placed on them by Moscow, their predominant trade and security partner, and partly because the large amounts of money they can earn.

A comprehensive analysis of export data from 24 advanced nations and key emerging markets reveals a significant upsurge in exports to Central Asian countries, according to a deep dive into international trade by the Institute of International Finance (IIF).

“We find a widespread surge in exports to Central Asia, which is most pronounced for countries where direct exports to Russia have fallen sharply or where there is geographic proximity to Russia, as in the cases of Poland or Lithuania,” says Robin Brooks, chief economist with Institute of International Finance (IIF) in the report.

“Our results should not be read as indicating an obvious violation of export controls, as we only look at aggregate level export data, which do not shed light on what goods are being exported. However, the unprecedented boom in trade with Central Asia raises important questions. After all, why incur the added transportation cost of shipping goods to landlocked countries with often limited cargo capacity, unless shipments in question are at the very least questionable under current export controls ,” says Brooks.

Much of this diversion trade is happening at the level of corporates and it is not clear if it is local companies owned by locals, or Russian-owned front companies set up in third countries that are behind the boom in trade.

According to a recent investigation by IIF, it appears the boom in semiconductor exports from Estonia to Russia was due to two companies registered in Estonia by Russian businessmen.

In another investigation, the soaring trade between Russia and the United Arab Emirates (UAE) was largely being conducted by local UAE companies that simply ignored sanctions and boosted trade.

Government’s are now increasingly trying to crackdown on their own companies that are ignoring trade. This week the Swedish government instructed the country’s Chamber of Commerce to check the reasons for the sharp increase in exports to countries neighbouring the Russian Federation.

According to the Swedish Statistics Bureau, in 2023 the volume of exports from Sweden to Kazakhstan increased by 140% compared to the previous year and to Kyrgyzstan and Turkmenistan by 200%. The Embassy of Kazakhstan in Sweden reported that the trade turnover between these two countries in January-November 2022 amounted to $282mn, almost 40% higher than the previous year’s period. At the same time, exports from Sweden to Kazakhstan increased by 22.3%, amounting to $189.3mn.

The central issue revolves around the challenge of effectively monitoring export controls within the highly dispersed and decentralized nature of global trade. In contrast, Russia’s oil exports, primarily transported by Western-owned oil tankers, are highly concentrated. This difference underscores the significance of the G7 oil price cap in limiting Russia’s purchasing power and ultimately influencing the redirection of trade.

Brooks has been an ardent advocate for lowering the oil price cap sanctions price of oil from $60 per barrel to $35 as he says that is the most effective way of cutting the Kremlin off from its main source of income. Beefing up the sanctions on the rest of Russia’s trade, he admits is more difficult due to the difficulties of, in effect, monitoring the entire global trade network and specifically following every type of good being traded.

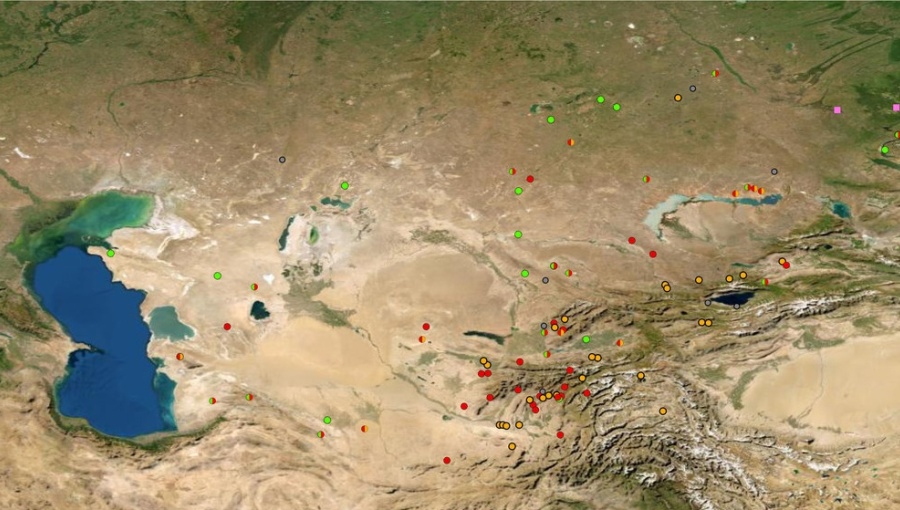

Examining the data across 24 countries, including direct exports to Russia and exports to Central Asian nations such as Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, provides insights into this shift says IIF. Although Belarus is not situated in Central Asia, it is included in the “trade diversion” category due to its surge in trade activity, mirroring the pattern seen in several other countries.

“We show monthly dollar-denominated export values for the US and for Germany. Both are good representations of what’s been happening in most western countries: (i) direct exports to Russia have fallen sharply; and (ii) there is a boom in exports to Central Asia, which in part offsets the drop in direct exports to Russia. Trade diversion is especially pronounced for countries in geographic proximity to Russia, including Poland and Lithuania. In the latter case, the rise in exports to Central Asia is so big that it more than offsets the fall in direct trade with Russia,” says Brooks.

Calculating the growth rate in trade from the first half of 2019 to the first half of 2023 for exports to Russia and Central Asia gives some more detail on the changes in trade flow. Notably, Turkey, China, and India exhibit a unique pattern, featuring both a rise in direct exports to Russia and substantial increases in exports to Central Asia, IIF found.

In Western countries, there was strong overall growth in exports in Latvia, Estonia, Switzerland, and Lithuania. Conversely, most Western nations show predominantly negative export growth, with trade diversion flows providing only partial offsets.

“[The data] shows that trade diversion flows are most pronounced for countries where direct exports to Russia have fallen most, including Denmark, Finland, Great Britain, and the US. Overall, our results underscore how difficult it is to police global trade effectively, given how dispersed and decentralized it is,” Brooks says.

Trade data shows that Russia has largely managed to avoid sanctions by rerouting trade through multiple geographies making it exceedingly difficult to track as it is impossible to determing the ultimate end-destination at the origin of the trade.

Since the start of the sanctions regimes the West has been increasingly involved in a game of whack-a-mole. Western and Russian diplomats have been travelling the world recently trying to shore up support and the US in particular has been imposing second sanctions on abusers, or threating to impose them, but with little effect. Technology sanctions, for example, have had little to no effect as Russia continues to have access to western technology via intermediates, according to various reports.

Source : BNE IntelliNews